Risk Management in Agriculture

Based on surveys by the World Meteorological Organization (WMO), meteorological and climate analyzes in recent years show, both globally and nationally, a significant increase in adverse weather events. 2018 turned out to be the hottest year on record after a record 2016. Globally, between 2015 and 2019, the WMO estimates an average rise in temperatures compared to the pre-industrial period of 1.1 ° C, as well as an increase in the frequency and intensity of so-called climatic events. "extreme" (heat wave, hurricanes, droughts and floods).

In this context, the players in the vine and wine sector are reflecting on how to ensure harvests and, more generally, on the tools for stabilizing agricultural income and on the role of public authorities in this context.

New needs are emerging on the part of agricultural businesses, which will undoubtedly stimulate and guide a process of reforming the supply of risk management tools (insurance and mutual funds).

Given the direct relationship between the variability of production yields and the variability of weather conditions, there is a latent demand in the primary sector for the development of private risk management tools. Among these instruments, the one best known to operators in the primary sector is undoubtedly agricultural insurance.

In Italy, a public intervention structure exists to guarantee the level of "well-being" of operators in the primary sector. It offers, among other things, compensatory aid guaranteed to farmers in the event of damage to agricultural production, with subsidies to insurance premiums and interventions to compensate for damage in the event of disasters.

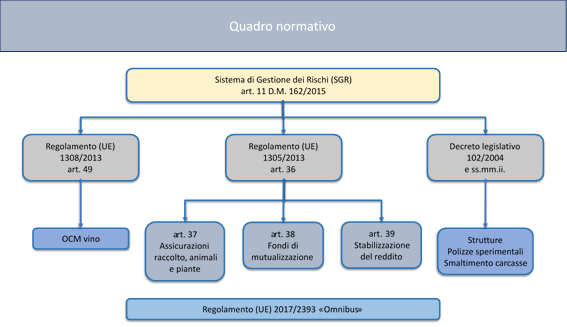

Over the past decades, the topic of risk management has also entered the European debate on the CAP. It received legislative attention at EU level and the approval of the Health Check (EU Regulation 73/2009) which for the first time offered Member States the possibility of using, in a generalized way, part of the financial resources allocated to direct payments to support farmers' access to two types of coverage: insurance policies and mutual funds for damage to production caused by adverse weather conditions, plant diseases, animal diseases and environmental emergencies.

It is with the current program, however, that direct support is given to risk management tools with dedicated financial resources, by introducing a "risk management toolbox". With the 2013 reform, a set of measures made available to Member States within the framework of rural development was created to facilitate the use of three coverage tools by farmers. In addition to the facilities for stipulating insurance policies and mutual funds, a new tool, the Income Stabilization Tool (IST), has been introduced. The latter is particularly innovative, not so much by its formula (mutual as in the case of damage cover funds), but by the fact that the risk of suffering significant drops in the company's income is covered.

The discipline of the toolbox is entrusted to articles 37, 38 and 39 of regulation 1305/2013 which defines the three types of intervention:

Financial contributions to insurance policies against bad weather conditions, plant diseases, animal diseases, parasitic infestations (art. 37). The contribution covers part of the cost of the insurance (65%) and the coverage occurs when the loss exceeds 30% of the average annual production of the farmer.

financial contributions to mutual funds for plant diseases, epizootics, environmental emergencies (art. 38). The contribution covers part of the losses (65%) and compensation is paid when the loss exceeds 30% of the average annual production of the farmer.

financial contributions to mutual funds for income stabilization - income stabilization tool (art.39). The contribution covers part of the drop in income (65%) and compensation occurs when the loss exceeds 20% of the average annual income of the farmer.

In Italy, we opted for a national measure, rather than a regional one, financing the national agricultural insurance program and other instruments, trying to overcome the lack of homogeneity and regional fragmentation with regard to access. to the insurance instrument recorded in previous years.

Following the approval of the transitional regulation for the extension of the CAP, in the years 2021 and 2022, the Union continues to grant support to the measures included in the current PDRN under the conditions of the current CAP framework. Thus, the financing of rural development programs and of the PDRN in particular is extended with the corresponding budgetary allocation for the years 2021 and 2022.

With regard to risk management tools, the current PDRN allocations for the years 2021 and 2022 will be ensured. In addition, the transitional regulation amended two provisions concerning mutual funds for bad weather conditions and plant diseases and IST (general income stabilization instrument) allowing Member States to lower the damage threshold by 30 at 20%.

|

Insurance policies for crops, animals and plants |

Damage threshold > 20%: |

FEASR (PSRN) FSN _______________________ |

Max 70% of the permitted expenditure |

|

-Vegetable production |

|||

|

-Animal husbandry (guarantee lack of income; forced slaughter, lack of milk production due to hygrothermal imbalances) -------------------------------------------------------------------- |

|||

|

-Vegetable production (risk coverage) ______ ___________________________________ |

Max 65% of the permitted expenditure |

||

|

Without damage threshold : |

r 1 FSN |

Max 50% of the permitted expenditure |

|

|

-Carcass disposal |

|||

|

-corporate structures |

|||

|

Index based policies (cereals, fodder, oilseeds, tomato, citrus, cucurbits, olives) |

Damage threshold > 30% |

FSN |

Max 65% of the permitted expenditure |

|

Revenue policies (durum and soft wheat |

Damage threshold > 20% |

FSN |

Max 65% of the permitted expenditure |

|

Mutual funds for adverse weather conditions, epizootic and plant diseases, parasitic infestations and environmental emergencies |

Damage threshold > 30% |

FEASR (PSRN) |

Max 70% of the permitted expenditure |

|

Mutual funds for sectoral income losses (durum wheat, olive growing, fruit and vegetables, poultry farming, cow's milk, sheep's milk) |

Income reduction threshold > 20% |

FEASR (PSRN) |

Max 70% of the permitted expenditure |

MAIN PRODUCTS BY INSURED VALUES

|

Product |

K € |

Weight % |

|

Wine grapes |

1.778.564 |

31,3% |

|

Apples |

717.912 |

12,6% |

|

Rice |

426.600 |

7,5% |

|

Corn |

312.172 |

5,5% |

|

Tomato for industry |

274.925 |

4,8% |

|

Corn for silage |

208.881 |

3,7% |

|

Pears |

203.980 |

3,6% |

|

Tobacco |

160.826 |

2,8% |

|

Actinidia |

150.303 |

2,6% |

|

Soft wheat |

123.471 |

2,2% |

|

Fruit trees |

119.246 |

2,1% |

|

Soybeans |

114.391 |

2,0% |

|

Nectarines |

112.822 |

2,0% |

|

Hard wheat |

95.009 |

1,7% |

|

Apricots |

68.330 |

1,2% |

|

Other crops |

812.365 |

14,3% |

|

Total |

5.679.798 |

100,0% |

THE MAIN PRODUCTS BY INSURED SURFACES

|

Product |

Hectars |

Weight % |

|

Wine grapes |

171.895 |

15,4% |

|

Rice |

166.373 |

14,9% |

|

Corn |

142.637 |

12,8% |

|

Tomato for industry |

35.819 |

3,2% |

|

Silage corn |

95.682 |

8,6% |

|

Soft wheat |

93.635 |

8,4% |

|

Soybean |

69.661 |

6,2% |

|

Durum wheat |

59.868 |

5,4% |

|

Biomass corn |

27.020 |

2,4% |

|

Apples |

26.901 |

2,4% |

|

Other crops |

228.469 |

20,4% |

|

Total |

1.117.961 |

100,0% |

By ASNACODI (Italy)

Σχέσεις

- Δίκτυο

- Λίστα

- Γεωτοποθεσία

- Περισσότερα

Comme le montre cet article de Vitisphere, les négociations sur les paramètres de la nouvelle assurance multirisque climatique sont toujours en cours

- Περισσότερα

FEM - Fondazione Edmund Mach

The Edmund Mach Foundation promotes and carries out research, scientific experiments, education and training activities as well as providing technical assistance and extensions services to companies

- Περισσότερα

INRAE - Institut national de recherche en agriculture, alimentation et environnement

INRAE, l’Institut national de recherche en agriculture, alimentation et environnement est né le 1er janvier 2020. Il est issu de la fusion entre l’Inra et Irstea

- Περισσότερα

Unité Mixye de Recherche INNOVATION

l'UMR Innovation vise à produire des connaissances et contribuer aux débats scientifiques et sociétaux sur les processus d’innovation qui participent aux transformations des systèmes agricoles et alimentaires, face aux enjeux globaux, dont le changement climatique